Buying a home is one of the biggest financial commitments most people will ever make, and securing a mortgage is a key part of that process. Whether you’re a first-time homebuyer, facing foreclosure, or dealing with a home in probate, understanding how mortgages work is essential.

At HHH Manor Real Estate, we specialize in foreclosures, probate sales, and lien resolutions, helping homeowners navigate complex situations. In this blog, we’ll break down the mortgage process and what you need to know about home loans.

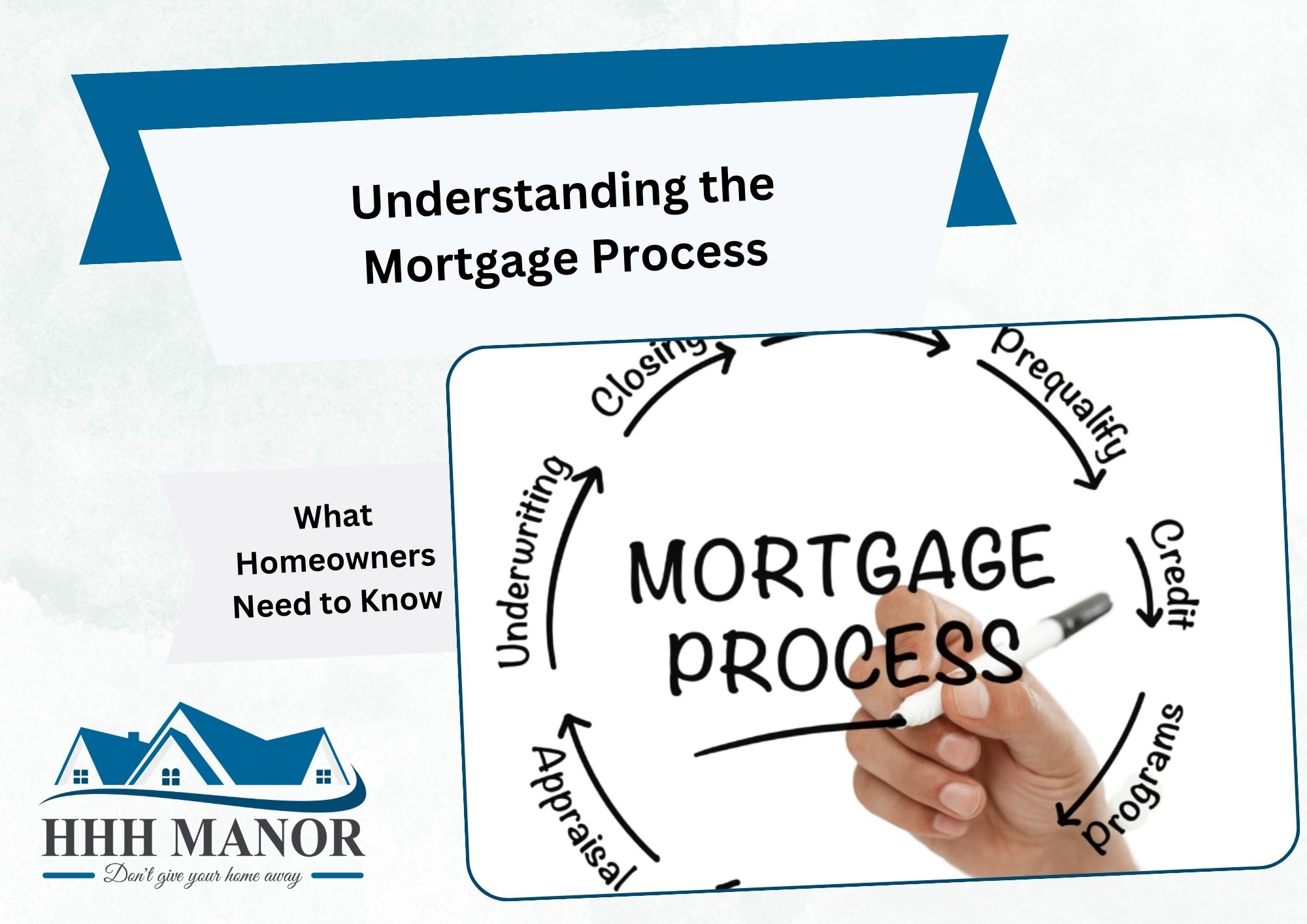

Step-by-Step Breakdown of the Mortgage Process

1. Pre-Approval: Know Your Buying Power

Before shopping for a home, it’s important to get pre-approved by a lender. This helps you understand how much you can borrow and shows sellers that you’re a serious buyer.

What You’ll Need:

- Proof of income (pay stubs, tax returns)

- Credit score review

- Employment verification

- Debt-to-income (DTI) ratio assessment

Tip: A higher credit score and lower debt improve your mortgage terms.

2. House Hunting & Making an Offer

Once pre-approved, you can start searching for homes within your budget. When you find the right home, you’ll submit an offer with your real estate agent.

- For traditional buyers: The seller reviews and accepts (or negotiates) your offer.

- For foreclosure or probate properties: The process may involve court approval or additional steps.

3. Loan Application & Underwriting

After the seller accepts your offer, your lender will begin the official loan process. This includes:

- Loan Application: Submitting all necessary financial documents.

- Home Appraisal: The lender verifies that the home’s value supports the loan amount.

- Underwriting: The lender evaluates your finances and ensures you meet loan requirements.

4. Loan Approval & Closing

If everything checks out, the lender issues a clear-to-close, meaning you’re approved! You’ll then attend a closing meeting, where you sign the final paperwork and officially take ownership.

- Pay closing costs (usually 2-5% of the home price).

- Receive the keys to your new home!

Mortgage Challenges: Foreclosure, Probate, and Liens

Homeowners sometimes face challenges with their mortgage that can lead to financial distress. Here’s what to watch for:

Foreclosure Risks

- Missing mortgage payments can lead to foreclosure if not resolved.

- Options to avoid foreclosure include loan modification, short sale, or selling before foreclosure proceedings begin.

Probate Properties with a Mortgage

- If you inherit a home with a mortgage, you must continue payments or explore options like refinancing or selling.

- Probate sales involve legal processes that can delay transactions, so it’s important to work with an expert.

Liens on a Home

- Tax liens, contractor liens, or unpaid debts can prevent a home sale until resolved.

- Title searches will reveal any existing liens, and homeowners must clear them before selling.

Final Thoughts

Understanding the mortgage process is crucial for homeowners and buyers alike. Whether you’re purchasing a home, facing foreclosure, probate, or liens, knowing how mortgages work will help you make informed decisions.

At HHH Manor Real Estate, we specialize in complex real estate transactions, ensuring you have the guidance needed for a smooth process.

Need expert advice? Contact us today to explore your options.

Stay informed—explore our blog for more real estate insights!